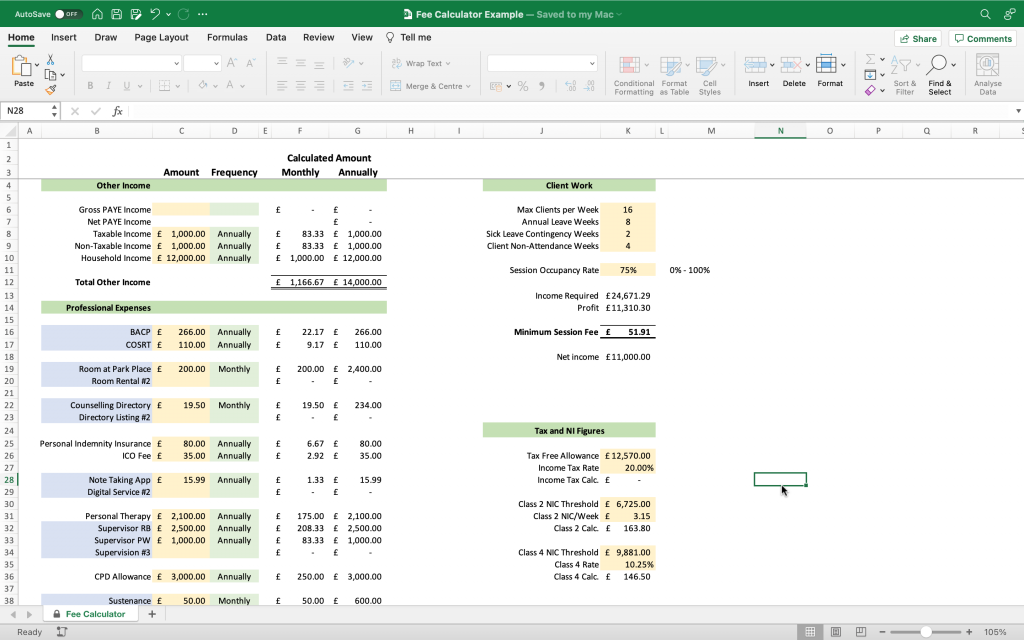

Self-Employment Budgeting Tool | Minimum Session Fee Calculator | Private Practice

Excel Spreadsheet

Digital Download

£10.00

VAT Included

Purchase via stripe Secure Checkout

How do you set your session fee for your private practice? Perhaps you chose a session fee based on what you feel you are worth? Maybe you set you fee after looking at what other people are charging in your local area? However you got there, you probably started with a figure and worked it out from there.

This is not a reliable way to calculate your fee.

Your fee should always be based on what you need to operate a sustainable private practice and the Minimum Fee Calculator can help you identify your minimum session fee without the guesswork. This calculator is specifically built for people within the helping professions, working self-employed with a client base of their own.

This spreadsheet is easy to use and a reliable way of checking whether you are charging a fee that is realistic and appropriate for your practice. When generating a fee, the calculator takes all of the following into consideration:

- All other income including PAYE (employed) income, taxable and non-taxable income, and household income (benefits or partner income)

- Allowable business expenses (room hire, supervisions, resources, etc…)

- Personal expenses (mortgage, bills, groceries, savings, etc…)

- Whether the figure you are providing is a weekly, fortnightly, four-weekly, monthly, bi-monthly, quarterly or annual amount

- Your maximum weekly clients

- Your desired annual leave

- Allocation for possible sick leave

- Estimate of client non-attendance

- Your expected session occupancy rate (0-100%)

- Calculation of Tax and NI for the end of the year tax return (for guidance only)

Note: The spreadsheet requires you to have completed a separate personal budget so you can input your totals for the different income types and a total for personal expenses. When calculating your personal expenses, remember to include your needs, wants, savings and any debt repayments. Finally, avoid duplicating expenses on both your personal and professional expense calculations.

Disclaimer: The tax and national insurance projections are for guidance only. The tax figure does not account for those earning more than the higher tax threshold. This spreadsheet is a budgeting tool, so please seek out a financial advisor if you need help with what expenses you can claim.

Please get in touch if you have any questions about whether this is the right product for your practice.

Secure Checkout with Stripe

This calculator is offered as an instant download. After you have made your purchase, you will receive the Excel Spreadsheet. The spreadsheet is compatible with Microsoft Excel 2011 onwards and Google Sheets. Since this is a digital product, all sales are final and no refunds will be available.